Course Description

A typical organization loses an estimated 5% of its yearly revenue to fraud. In this course, learn to fight fraud by using data. Apply supervised learning algorithms to detect fraudulent behavior based upon past fraud, and use unsupervised learning methods to discover new types of fraud activities.

Fraudulent transactions are rare compared to the norm. As such, learn to properly classify imbalanced datasets.

The course provides technical and theoretical insights and demonstrates how to implement fraud detection models. Finally, get tips and advice from real-life experience to help prevent common mistakes in fraud analytics.

Imports

1

2

3

| import warnings

warnings.filterwarnings('ignore')

warnings.simplefilter('ignore')

|

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

| import pandas as pd

import matplotlib.pyplot as plt

from matplotlib.patches import Rectangle

import numpy as np

from pprint import pprint as pp

import csv

from pathlib import Path

import seaborn as sns

from itertools import product

import string

import nltk

from nltk.corpus import stopwords

from nltk.stem.wordnet import WordNetLemmatizer

from imblearn.over_sampling import SMOTE

from imblearn.over_sampling import BorderlineSMOTE

from imblearn.pipeline import Pipeline

from sklearn.linear_model import LinearRegression, LogisticRegression

from sklearn.model_selection import train_test_split, GridSearchCV

from sklearn.tree import DecisionTreeClassifier

from sklearn.metrics import r2_score, classification_report, confusion_matrix, accuracy_score, roc_auc_score, roc_curve, precision_recall_curve, average_precision_score

from sklearn.metrics import homogeneity_score, silhouette_score

from sklearn.ensemble import RandomForestClassifier, VotingClassifier

from sklearn.preprocessing import MinMaxScaler

from sklearn.cluster import MiniBatchKMeans, DBSCAN

import gensim

from gensim import corpora

from gensim.models.ldamodel import LdaModel

from gensim.corpora.dictionary import Dictionary

from typing import List, Tuple

|

Pandas Configuration Options

1

2

3

4

| pd.set_option('display.max_columns', 700)

pd.set_option('display.max_rows', 400)

pd.set_option('display.min_rows', 10)

pd.set_option('display.expand_frame_repr', True)

|

Data Files Location

- Most data files for the exercises can be found on the course site

Data File Objects

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

| data = Path.cwd() / 'data' / 'fraud_detection'

ch1 = data / 'chapter_1'

cc1_file = ch1 / 'creditcard_sampledata.csv'

cc3_file = ch1 / 'creditcard_sampledata_3.csv'

ch2 = data / 'chapter_2'

cc2_file = ch2 / 'creditcard_sampledata_2.csv'

ch3 = data / 'chapter_3'

banksim_file = ch3 / 'banksim.csv'

banksim_adj_file = ch3 / 'banksim_adj.csv'

db_full_file = ch3 / 'db_full.pickle'

labels_file = ch3 / 'labels.pickle'

labels_full_file = ch3 / 'labels_full.pickle'

x_scaled_file = ch3 / 'x_scaled.pickle'

x_scaled_full_file = ch3 / 'x_scaled_full.pickle'

ch4 = data / 'chapter_4'

enron_emails_clean_file = ch4 / 'enron_emails_clean.csv'

cleantext_file = ch4 / 'cleantext.pickle'

corpus_file = ch4 / 'corpus.pickle'

dict_file = ch4 / 'dict.pickle'

ldamodel_file = ch4 / 'ldamodel.pickle'

|

Introduction and preparing your data

Learn about the typical challenges associated with fraud detection. Learn how to resample data in a smart way, and tackle problems with imbalanced data.

Introduction to fraud detection

- Types:

- Insurance

- Credit card

- Identity theft

- Money laundering

- Tax evasion

- Healthcare

- Product warranty

- e-commerce businesses must continuously assess the legitimacy of client transactions

- Detecting fraud is challenging:

- Uncommon; < 0.01% of transactions

- Attempts are made to conceal fraud

- Behavior evolves

- Fraudulent activities perpetrated by networks - organized crime

- Fraud detection requires training an algorithm to identify concealed observations from any normal observations

- Fraud analytics teams:

- Often use rules based systems, based on manually set thresholds and experience

- Check the news

- Receive external lists of fraudulent accounts and names

- suspicious names or track an external hit list from police to reference check against the client base

- Sometimes use machine learning algorithms to detect fraud or suspicious behavior

- Existing sources can be used as inputs into the ML model

- Verify the veracity of rules based labels

Checking the fraud to non-fraud ratio

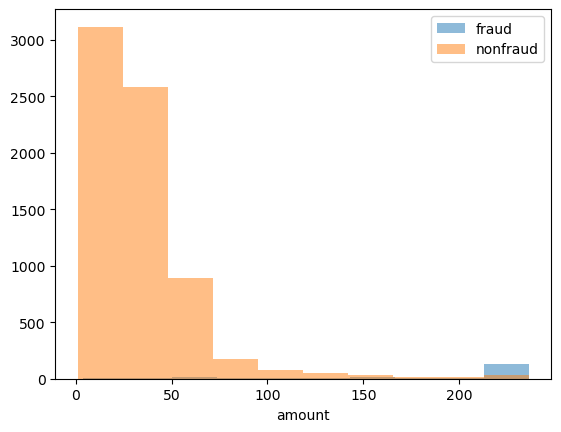

In this chapter, you will work on creditcard_sampledata.csv, a dataset containing credit card transactions data. Fraud occurrences are fortunately an extreme minority in these transactions.

However, Machine Learning algorithms usually work best when the different classes contained in the dataset are more or less equally present. If there are few cases of fraud, then there’s little data to learn how to identify them. This is known as class imbalance, and it’s one of the main challenges of fraud detection.

Let’s explore this dataset, and observe this class imbalance problem.

Instructions

import pandas as pd, read the credit card data in and assign it to df. This has been done for you.- Use

.info() to print information about df. - Use

.value_counts() to get the count of fraudulent and non-fraudulent transactions in the 'Class' column. Assign the result to occ. - Get the ratio of fraudulent transactions over the total number of transactions in the dataset.

1

| df = pd.read_csv(cc3_file)

|

Explore the features available in your dataframe

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

| <class 'pandas.core.frame.DataFrame'>

RangeIndex: 5050 entries, 0 to 5049

Data columns (total 31 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Unnamed: 0 5050 non-null int64

1 V1 5050 non-null float64

2 V2 5050 non-null float64

3 V3 5050 non-null float64

4 V4 5050 non-null float64

5 V5 5050 non-null float64

6 V6 5050 non-null float64

7 V7 5050 non-null float64

8 V8 5050 non-null float64

9 V9 5050 non-null float64

10 V10 5050 non-null float64

11 V11 5050 non-null float64

12 V12 5050 non-null float64

13 V13 5050 non-null float64

14 V14 5050 non-null float64

15 V15 5050 non-null float64

16 V16 5050 non-null float64

17 V17 5050 non-null float64

18 V18 5050 non-null float64

19 V19 5050 non-null float64

20 V20 5050 non-null float64

21 V21 5050 non-null float64

22 V22 5050 non-null float64

23 V23 5050 non-null float64

24 V24 5050 non-null float64

25 V25 5050 non-null float64

26 V26 5050 non-null float64

27 V27 5050 non-null float64

28 V28 5050 non-null float64

29 Amount 5050 non-null float64

30 Class 5050 non-null int64

dtypes: float64(29), int64(2)

memory usage: 1.2 MB

|

| Unnamed: 0 | V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | V10 | V11 | V12 | V13 | V14 | V15 | V16 | V17 | V18 | V19 | V20 | V21 | V22 | V23 | V24 | V25 | V26 | V27 | V28 | Amount | Class |

|---|

| 0 | 258647 | 1.725265 | -1.337256 | -1.012687 | -0.361656 | -1.431611 | -1.098681 | -0.842274 | -0.026594 | -0.032409 | 0.215113 | 1.618952 | -0.654046 | -1.442665 | -1.546538 | -0.230008 | 1.785539 | 1.419793 | 0.071666 | 0.233031 | 0.275911 | 0.414524 | 0.793434 | 0.028887 | 0.419421 | -0.367529 | -0.155634 | -0.015768 | 0.010790 | 189.00 | 0 |

|---|

| 1 | 69263 | 0.683254 | -1.681875 | 0.533349 | -0.326064 | -1.455603 | 0.101832 | -0.520590 | 0.114036 | -0.601760 | 0.444011 | 1.521570 | 0.499202 | -0.127849 | -0.237253 | -0.752351 | 0.667190 | 0.724785 | -1.736615 | 0.702088 | 0.638186 | 0.116898 | -0.304605 | -0.125547 | 0.244848 | 0.069163 | -0.460712 | -0.017068 | 0.063542 | 315.17 | 0 |

|---|

| 2 | 96552 | 1.067973 | -0.656667 | 1.029738 | 0.253899 | -1.172715 | 0.073232 | -0.745771 | 0.249803 | 1.383057 | -0.483771 | -0.782780 | 0.005242 | -1.273288 | -0.269260 | 0.091287 | -0.347973 | 0.495328 | -0.925949 | 0.099138 | -0.083859 | -0.189315 | -0.426743 | 0.079539 | 0.129692 | 0.002778 | 0.970498 | -0.035056 | 0.017313 | 59.98 | 0 |

|---|

| 3 | 281898 | 0.119513 | 0.729275 | -1.678879 | -1.551408 | 3.128914 | 3.210632 | 0.356276 | 0.920374 | -0.160589 | -0.801748 | 0.137341 | -0.156740 | -0.429388 | -0.752392 | 0.155272 | 0.215068 | 0.352222 | -0.376168 | -0.398920 | 0.043715 | -0.335825 | -0.906171 | 0.108350 | 0.593062 | -0.424303 | 0.164201 | 0.245881 | 0.071029 | 0.89 | 0 |

|---|

| 4 | 86917 | 1.271253 | 0.275694 | 0.159568 | 1.003096 | -0.128535 | -0.608730 | 0.088777 | -0.145336 | 0.156047 | 0.022707 | -0.963306 | -0.228074 | -0.324933 | 0.390609 | 1.065923 | 0.285930 | -0.627072 | 0.170175 | -0.215912 | -0.147394 | 0.031958 | 0.123503 | -0.174528 | -0.147535 | 0.735909 | -0.262270 | 0.015577 | 0.015955 | 6.53 | 0 |

|---|

1

2

3

| # Count the occurrences of fraud and no fraud and print them

occ = df['Class'].value_counts()

occ

|

1

2

3

4

| Class

0 5000

1 50

Name: count, dtype: int64

|

1

2

3

| # Print the ratio of fraud cases

ratio_cases = occ/len(df.index)

print(f'Ratio of fraudulent cases: {ratio_cases[1]}\nRatio of non-fraudulent cases: {ratio_cases[0]}')

|

1

2

| Ratio of fraudulent cases: 0.009900990099009901

Ratio of non-fraudulent cases: 0.9900990099009901

|

The ratio of fraudulent transactions is very low. This is a case of class imbalance problem, and you’re going to learn how to deal with this in the next exercises.

Data visualization

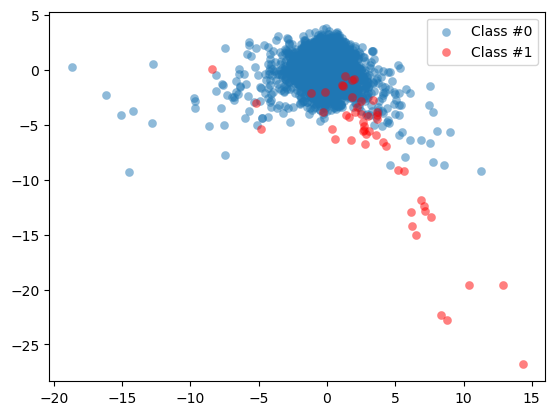

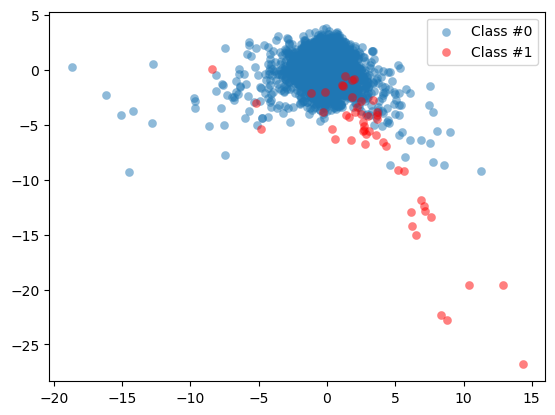

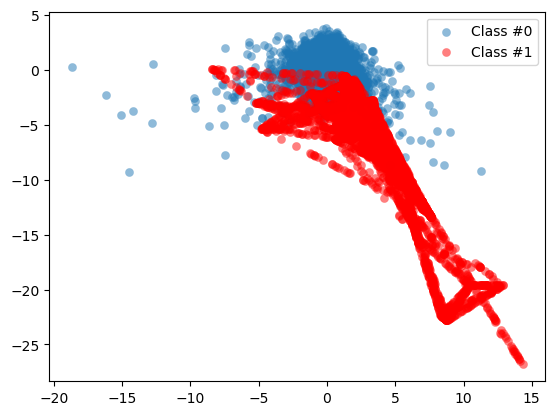

From the previous exercise we know that the ratio of fraud to non-fraud observations is very low. You can do something about that, for example by re-sampling our data, which is explained in the next video.

In this exercise, you’ll look at the data and visualize the fraud to non-fraud ratio. It is always a good starting point in your fraud analysis, to look at your data first, before you make any changes to it.

Moreover, when talking to your colleagues, a picture often makes it very clear that we’re dealing with heavily imbalanced data. Let’s create a plot to visualize the ratio fraud to non-fraud data points on the dataset df.

The function prep_data() is already loaded in your workspace, as well as matplotlib.pyplot as plt.

Instructions

- Define the

plot_data(X, y) function, that will nicely plot the given feature set X with labels y in a scatter plot. This has been done for you. - Use the function

prep_data() on your dataset df to create feature set X and labels y. - Run the function

plot_data() on your newly obtained X and y to visualize your results.

def prep_data

1

2

3

4

5

6

7

8

9

| def prep_data(df: pd.DataFrame) -> (np.ndarray, np.ndarray):

"""

Convert the DataFrame into two variable

X: data columns (V1 - V28)

y: lable column

"""

X = df.iloc[:, 2:30].values

y = df.Class.values

return X, y

|

def plot_data

1

2

3

4

5

6

| # Define a function to create a scatter plot of our data and labels

def plot_data(X: np.ndarray, y: np.ndarray):

plt.scatter(X[y == 0, 0], X[y == 0, 1], label="Class #0", alpha=0.5, linewidth=0.15)

plt.scatter(X[y == 1, 0], X[y == 1, 1], label="Class #1", alpha=0.5, linewidth=0.15, c='r')

plt.legend()

return plt.show()

|

1

2

| # Create X and y from the prep_data function

X, y = prep_data(df)

|

1

2

| # Plot our data by running our plot data function on X and y

plot_data(X, y)

|

By visualizing the data, you can immediately see how our fraud cases are scattered over our data, and how few cases we have. A picture often makes the imbalance problem clear. In the next exercises we’ll visually explore how to improve our fraud to non-fraud balance.

Reproduced using the DataFrame

1

2

3

4

| plt.scatter(df.V2[df.Class == 0], df.V3[df.Class == 0], label="Class #0", alpha=0.5, linewidth=0.15)

plt.scatter(df.V2[df.Class == 1], df.V3[df.Class == 1], label="Class #1", alpha=0.5, linewidth=0.15, c='r')

plt.legend()

plt.show()

|

Increase successful detections with data resampling

- resampling can help model performance in cases of imbalanced data sets

Undersampling

- Undersampling the majority class (non-fraud cases)

- Straightforward method to adjust imbalanced data

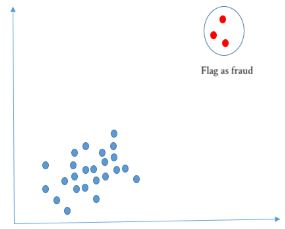

- Take random draws from the non-fraud observations, to match the occurences of fraud observations (as shown in the picture)

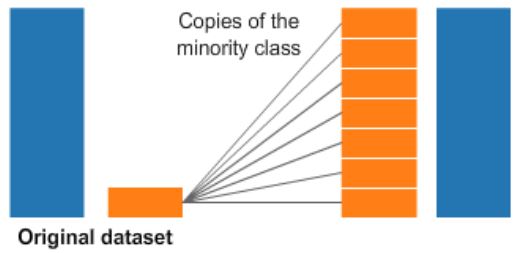

Oversampling

- Oversampling the minority class (fraud cases)

- Take random draws from the fraud cases and copy those observations to increase the amount of fraud samples

- Both methods lead to having a balance between fraud and non-fraud cases

- Drawbacks

- with random undersampling, a lot of information is thrown away

- with oversampling, the model will be trained on a lot of duplicates

Implement resampling methods using Python imblean module

- compatible with scikit-learn

1

2

3

4

5

6

| from imblearn.over_sampling import RandomOverSampler

method = RandomOverSampler()

X_resampled, y_resampled = method.fit_sample(X, y)

compare_plots(X_resampled, y_resampled, X, y)

|

- The darker blue points reflect there are more identical data

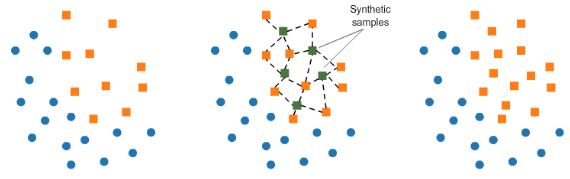

SMOTE

- Synthetic minority Oversampling Technique (SMOTE)

- Resampling strategies for Imbalanced Data Sets

- Another way of adjusting the imbalance by oversampling minority observations

- SMOTE uses characteristics of nearest neighbors of fraud cases to create new synthetic fraud cases

- avoids duplicating observations

Determining the best resampling method is situational

- Random Undersampling (RUS):

- If there is a lot of data and many minority cases, then undersampling may be computationally more convenient

- In most cases, throwing away data is not desirable

- Random Oversampling (ROS):

- Straightforward

- Training the model on many duplicates

- SMOTE:

- more sophisticated

- realistic data set

- training on synthetic data

- only works well if the minority case features are similar

- if fraud is spread through the data and not distinct, using nearest neighbors to create more fraud cases, introduces noise into the data, as the nearest neighbors might not be fraud cases

When to use resmapling methods

- Use resampling methods on the training set, not on the test set

- The goal is to produce a better model by providing balanced data

- The goal is not to predict the synthetic samples

- Test data should be free of duplicates and synthetic data

- Only test the model on real data

- First, spit the data into train and test sets

1

2

3

4

5

6

7

8

9

10

11

12

13

14

| # Define resampling method and split into train and test

method = SMOTE(kind='borderline1')

X_train, X_test, y_train, y_test = train_test_split(X, y, train_size=0.8, random_state=0)

# Apply resampling to the training data only

X_resampled, y_resampled = method.fit_sample(X_train, y_train)

# Continue fitting the model and obtain predictions

model = LogisticRegression()

model.fit(X_resampled, y_resampled)

# Get model performance metrics

predicted = model.predict(X_test)

print(classification_report(y_test, predicted))

|

Resampling methods for imbalanced data

Which of these methods takes a random subsample of your majority class to account for class “imbalancedness”?

Possible Answers

Random Over Sampling (ROS)- Random Under Sampling (RUS)

Synthetic Minority Over-sampling Technique (SMOTE)None of the above

By using ROS and SMOTE you add more examples to the minority class. RUS adjusts the balance of your data by reducing the majority class.

Applying Synthetic Minority Oversampling Technique (SMOTE)

In this exercise, you’re going to re-balance our data using the Synthetic Minority Over-sampling Technique (SMOTE). Unlike ROS, SMOTE does not create exact copies of observations, but creates new, synthetic, samples that are quite similar to the existing observations in the minority class. SMOTE is therefore slightly more sophisticated than just copying observations, so let’s apply SMOTE to our credit card data. The dataset df is available and the packages you need for SMOTE are imported. In the following exercise, you’ll visualize the result and compare it to the original data, such that you can see the effect of applying SMOTE very clearly.

Instructions

- Use the

prep_data function on df to create features X and labels y. - Define the resampling method as SMOTE of the regular kind, under the variable

method. - Use

.fit_sample() on the original X and y to obtain newly resampled data. - Plot the resampled data using the

plot_data() function.

1

2

| # Run the prep_data function

X, y = prep_data(df)

|

1

| print(f'X shape: {X.shape}\ny shape: {y.shape}')

|

1

2

| X shape: (5050, 28)

y shape: (5050,)

|

1

2

| # Define the resampling method

method = SMOTE()

|

1

2

| # Create the resampled feature set

X_resampled, y_resampled = method.fit_resample(X, y)

|

1

2

| # Plot the resampled data

plot_data(X_resampled, y_resampled)

|

The minority class is now much more prominently visible in our data. To see the results of SMOTE even better, we’ll compare it to the original data in the next exercise.

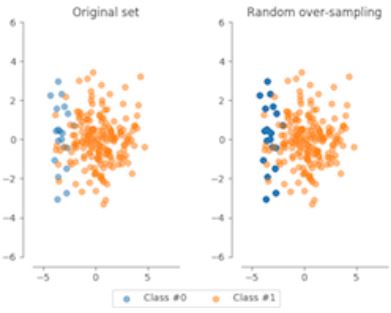

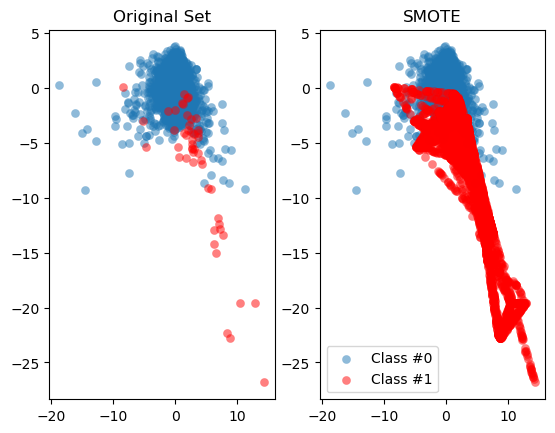

Compare SMOTE to original data

In the last exercise, you saw that using SMOTE suddenly gives us more observations of the minority class. Let’s compare those results to our original data, to get a good feeling for what has actually happened. Let’s have a look at the value counts again of our old and new data, and let’s plot the two scatter plots of the data side by side. You’ll use the function compare_plot() for that that, which takes the following arguments: X, y, X_resampled, y_resampled, method=''. The function plots your original data in a scatter plot, along with the resampled side by side.

Instructions

- Print the value counts of our original labels,

y. Be mindful that y is currently a Numpy array, so in order to use value counts, we’ll assign y back as a pandas Series object. - Repeat the step and print the value counts on

y_resampled. This shows you how the balance between the two classes has changed with SMOTE. - Use the

compare_plot() function called on our original data as well our resampled data to see the scatterplots side by side.

1

| pd.value_counts(pd.Series(y))

|

1

2

3

| 0 5000

1 50

Name: count, dtype: int64

|

1

| pd.value_counts(pd.Series(y_resampled))

|

1

2

3

| 0 5000

1 5000

Name: count, dtype: int64

|

def compare_plot

1

2

3

4

5

6

7

8

9

10

11

| def compare_plot(X: np.ndarray, y: np.ndarray, X_resampled: np.ndarray, y_resampled: np.ndarray, method: str):

plt.subplot(1, 2, 1)

plt.scatter(X[y == 0, 0], X[y == 0, 1], label="Class #0", alpha=0.5, linewidth=0.15)

plt.scatter(X[y == 1, 0], X[y == 1, 1], label="Class #1", alpha=0.5, linewidth=0.15, c='r')

plt.title('Original Set')

plt.subplot(1, 2, 2)

plt.scatter(X_resampled[y_resampled == 0, 0], X_resampled[y_resampled == 0, 1], label="Class #0", alpha=0.5, linewidth=0.15)

plt.scatter(X_resampled[y_resampled == 1, 0], X_resampled[y_resampled == 1, 1], label="Class #1", alpha=0.5, linewidth=0.15, c='r')

plt.title(method)

plt.legend()

plt.show()

|

1

| compare_plot(X, y, X_resampled, y_resampled, method='SMOTE')

|

It should by now be clear that SMOTE has balanced our data completely, and that the minority class is now equal in size to the majority class. Visualizing the data shows the effect on the data very clearly. The next exercise will demonstrate multiple ways to implement SMOTE and that each method will have a slightly different effect.

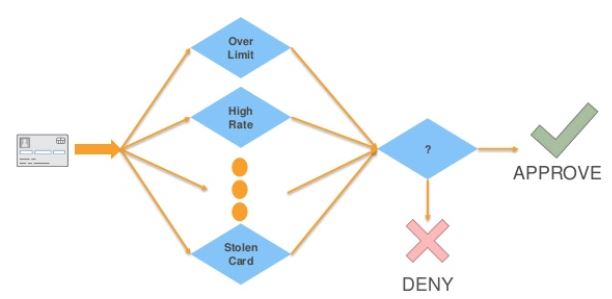

Fraud detection algorithms in action

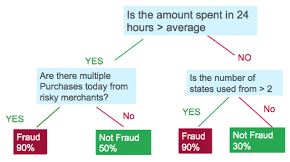

Rules Based Systems

- Might block transactions from risky zip codes

- Block transactions from cards used too frequently (e.g. last 30 minutes)

- Can catch fraud, but also generates false alarms (false positive)

- Limitations:

- Fixed threshold per rule and it’s difficult to determine the threshold; they don’t adapt over time

- Limited to yes / no outcomes, whereas ML yields a probability

- probability allows for fine-tuning the outcomes (i.e. rate of occurences of false positives and false negatives)

- Fails to capture interaction between features

- Ex. Size of the transaction only matters in combination to the frequency

ML Based Systems

- Adapt to the data, thus can change over time

- Uses all the data combined, rather than a threshold per feature

- Produces a probability, rather than a binary score

- Typically have better performance and can be combined with rules

1

2

| # Step 1: split the features and labels into train and test data

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2)

|

1

2

| # Step 2: Define which model to use

model = LinearRegression()

|

1

2

| # Step 3: Fit the model to the training data

model.fit(X_train, y_train)

|

LinearRegression()

In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook.

On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.1

2

| # Step 4: Obtain model predictions from the test data

y_predicted = model.predict(X_test)

|

1

2

| # Step 5: Compare y_test to predictions and obtain performance metrics (r^2 score)

r2_score(y_test, y_predicted)

|

Exploring the traditional method of fraud detection

In this exercise you’re going to try finding fraud cases in our credit card dataset the “old way”. First you’ll define threshold values using common statistics, to split fraud and non-fraud. Then, use those thresholds on your features to detect fraud. This is common practice within fraud analytics teams.

Statistical thresholds are often determined by looking at the mean values of observations. Let’s start this exercise by checking whether feature means differ between fraud and non-fraud cases. Then, you’ll use that information to create common sense thresholds. Finally, you’ll check how well this performs in fraud detection.

pandas has already been imported as pd.

Instructions

- Use

groupby() to group df on Class and obtain the mean of the features. - Create the condition

V1 smaller than -3, and V3 smaller than -5 as a condition to flag fraud cases. - As a measure of performance, use the

crosstab function from pandas to compare our flagged fraud cases to actual fraud cases.

1

| df.drop(['Unnamed: 0'], axis=1, inplace=True)

|

1

| df.groupby('Class').mean()

|

| V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | V10 | V11 | V12 | V13 | V14 | V15 | V16 | V17 | V18 | V19 | V20 | V21 | V22 | V23 | V24 | V25 | V26 | V27 | V28 | Amount |

|---|

| Class | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|---|

| 0 | 0.035030 | 0.011553 | 0.037444 | -0.045760 | -0.013825 | -0.030885 | 0.014315 | -0.022432 | -0.002227 | 0.001667 | -0.004511 | 0.017434 | 0.004204 | 0.006542 | -0.026640 | 0.001190 | 0.004481 | -0.010892 | -0.016554 | -0.002896 | -0.010583 | -0.010206 | -0.003305 | -0.000918 | -0.002613 | -0.004651 | -0.009584 | 0.002414 | 85.843714 |

|---|

| 1 | -4.985211 | 3.321539 | -7.293909 | 4.827952 | -3.326587 | -1.591882 | -5.776541 | 1.395058 | -2.537728 | -5.917934 | 4.020563 | -7.032865 | -0.104179 | -7.100399 | -0.120265 | -4.658854 | -7.589219 | -2.650436 | 0.894255 | 0.194580 | 0.703182 | 0.069065 | -0.088374 | -0.029425 | -0.073336 | -0.023377 | 0.380072 | 0.009304 | 113.469000 |

|---|

1

| df['flag_as_fraud'] = np.where(np.logical_and(df.V1 < -3, df.V3 < -5), 1, 0)

|

1

| pd.crosstab(df.Class, df.flag_as_fraud, rownames=['Actual Fraud'], colnames=['Flagged Fraud'])

|

| Flagged Fraud | 0 | 1 |

|---|

| Actual Fraud | | |

|---|

| 0 | 4984 | 16 |

|---|

| 1 | 28 | 22 |

|---|

With this rule, 22 out of 50 fraud cases are detected, 28 are not detected, and 16 false positives are identified.

Using ML classification to catch fraud

In this exercise you’ll see what happens when you use a simple machine learning model on our credit card data instead.

Do you think you can beat those results? Remember, you’ve predicted 22 out of 50 fraud cases, and had 16 false positives.

So with that in mind, let’s implement a Logistic Regression model. If you have taken the class on supervised learning in Python, you should be familiar with this model. If not, you might want to refresh that at this point. But don’t worry, you’ll be guided through the structure of the machine learning model.

The X and y variables are available in your workspace.

Instructions

- Split

X and y into training and test data, keeping 30% of the data for testing. - Fit your model to your training data.

- Obtain the model predicted labels by running

model.predict on X_test. - Obtain a classification comparing

y_test with predicted, and use the given confusion matrix to check your results.

1

2

| # Create the training and testing sets

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.3, random_state=0)

|

1

2

3

| # Fit a logistic regression model to our data

model = LogisticRegression(solver='liblinear')

model.fit(X_train, y_train)

|

LogisticRegression(solver='liblinear')

In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook.

On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.1

2

| # Obtain model predictions

predicted = model.predict(X_test)

|

1

2

3

4

| # Print the classifcation report and confusion matrix

print('Classification report:\n', classification_report(y_test, predicted))

conf_mat = confusion_matrix(y_true=y_test, y_pred=predicted)

print('Confusion matrix:\n', conf_mat)

|

1

2

3

4

5

6

7

8

9

10

11

12

13

| Classification report:

precision recall f1-score support

0 1.00 1.00 1.00 1505

1 0.89 0.80 0.84 10

accuracy 1.00 1515

macro avg 0.94 0.90 0.92 1515

weighted avg 1.00 1.00 1.00 1515

Confusion matrix:

[[1504 1]

[ 2 8]]

|

Do you think these results are better than the rules based model? We are getting far fewer false positives, so that’s an improvement. Also, we’re catching a higher percentage of fraud cases, so that is also better than before. Do you understand why we have fewer observations to look at in the confusion matrix? Remember we are using only our test data to calculate the model results on. We’re comparing the crosstab on the full dataset from the last exercise, with a confusion matrix of only 30% of the total dataset, so that’s where that difference comes from. In the next chapter, we’ll dive deeper into understanding these model performance metrics. Let’s now explore whether we can improve the prediction results even further with resampling methods.

Logistic regression with SMOTE

In this exercise, you’re going to take the Logistic Regression model from the previous exercise, and combine that with a SMOTE resampling method. We’ll show you how to do that efficiently by using a pipeline that combines the resampling method with the model in one go. First, you need to define the pipeline that you’re going to use.

Instructions

- Import the

Pipeline module from imblearn, this has been done for you. - Then define what you want to put into the pipeline, assign the

SMOTE method with borderline2 to resampling, and assign LogisticRegression() to the model. - Combine two steps in the

Pipeline() function. You need to state you want to combine resampling with the model in the respective place in the argument. I show you how to do this.

1

2

3

4

| # Define which resampling method and which ML model to use in the pipeline

# resampling = SMOTE(kind='borderline2') # has been changed to BorderlineSMOTE

resampling = BorderlineSMOTE()

model = LogisticRegression(solver='liblinear')

|

1

| pipeline = Pipeline([('SMOTE', resampling), ('Logistic Regression', model)])

|

Pipelining

Now that you have our pipeline defined, aka combining a logistic regression with a SMOTE method, let’s run it on the data. You can treat the pipeline as if it were a single machine learning model. Our data X and y are already defined, and the pipeline is defined in the previous exercise. Are you curious to find out what the model results are? Let’s give it a try!

Instructions

- Split the data ‘X’and ‘y’ into the training and test set. Set aside 30% of the data for a test set, and set the

random_state to zero. - Fit your pipeline onto your training data and obtain the predictions by running the

pipeline.predict() function on our X_test dataset.

1

2

| # Split your data X and y, into a training and a test set and fit the pipeline onto the training data

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.3, random_state=0)

|

1

2

| pipeline.fit(X_train, y_train)

predicted = pipeline.predict(X_test)

|

1

2

3

4

| # Obtain the results from the classification report and confusion matrix

print('Classifcation report:\n', classification_report(y_test, predicted))

conf_mat = confusion_matrix(y_true=y_test, y_pred=predicted)

print('Confusion matrix:\n', conf_mat)

|

1

2

3

4

5

6

7

8

9

10

11

12

13

| Classifcation report:

precision recall f1-score support

0 1.00 1.00 1.00 1505

1 0.59 1.00 0.74 10

accuracy 1.00 1515

macro avg 0.79 1.00 0.87 1515

weighted avg 1.00 1.00 1.00 1515

Confusion matrix:

[[1498 7]

[ 0 10]]

|

As you can see, the SMOTE slightly improves our results. We now manage to find all cases of fraud, but we have a slightly higher number of false positives, albeit only 7 cases. Remember, resampling doesn’t necessarily lead to better results. When the fraud cases are very spread and scattered over the data, using SMOTE can introduce a bit of bias. Nearest neighbors aren’t necessarily also fraud cases, so the synthetic samples might ‘confuse’ the model slightly. In the next chapters, we’ll learn how to also adjust our machine learning models to better detect the minority fraud cases.

Fraud detection using labeled data

Learn how to flag fraudulent transactions with supervised learning. Use classifiers, adjust and compare them to find the most efficient fraud detection model.

Review classification methods

- Classification:

- The problem of identifying to which class a new observation belongs, on the basis of a training set of data containing observations whose class is known

- Goal: use known fraud cases to train a model to recognize new cases

- Classes are sometimes called targets, labels or categories

- Spam detection in email service providers can be identified as a classification problem

- Binary classification since there are only 2 classes, spam and not spam

- Fraud detection is also a binary classification prpoblem

- Patient diagnosis

- Classification problems normall have categorical output like yes/no, 1/0 or True/False

- Variable to predict: \(y\in0,1\)

- 0: negative calss (‘majority’ normal cases)

- 1: positive class (‘minority’ fraud cases)

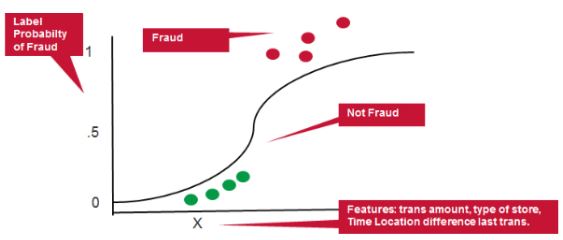

Logistic Regression

- Logistic Regression is one of the most used ML algorithms in binary classification

- Can be adjusted reasonably well to work on imbalanced data…useful for fraud detection

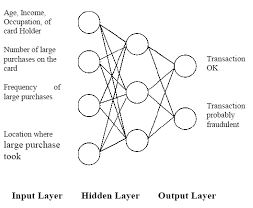

Neural Network

- Can be used as classifiers for fraud detection

- Capable of fitting highly non-linear models to the data

- More complex to implement than other classifiers - not demonstrated here

Decision Trees

- Commonly used for fraud detection

- Transparent results, easily interpreted by analysts

- Decision trees are prone to overfit the data

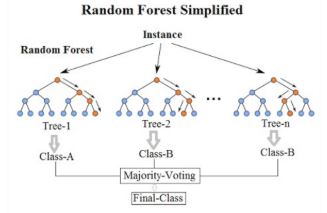

Random Forests

- Random Forests are a more robust option than a single decision tree

- Construct a multitude of decision trees when training the model and outputting the class that is the mode or mean predicted class of the individual trees

- A random forest consists of a collection of trees on a random subset of features

- Final predictions are the combined results of those trees

- Random forests can handle complex data and are not prone to overfit

- They are interpretable by looking at feature importance, and can be adjusted to work well on highly imbalanced data

- Their drawback is they’re computationally complex

- Very popular for fraud detection

- A Random Forest model will be optimized in the exercises

Implementation:

1

2

3

4

5

| from sklearn.ensemble import RandomForestClassifier

model = RandomForestClassifier()

model.fit(X_train, y_train)

predicted = model.predict(X_test)

print(f'Accuracy Score:\n{accuracy_score(y_test, predicted)}')

|

Natural hit rate

In this exercise, you’ll again use credit card transaction data. The features and labels are similar to the data in the previous chapter, and the data is heavily imbalanced. We’ve given you features X and labels y to work with already, which are both numpy arrays.

First you need to explore how prevalent fraud is in the dataset, to understand what the “natural accuracy” is, if we were to predict everything as non-fraud. It’s is important to understand which level of “accuracy” you need to “beat” in order to get a better prediction than by doing nothing. In the following exercises, you’ll create our first random forest classifier for fraud detection. That will serve as the “baseline” model that you’re going to try to improve in the upcoming exercises.

Instructions

- Count the total number of observations by taking the length of your labels

y. - Count the non-fraud cases in our data by using list comprehension on

y; remember y is a NumPy array so .value_counts() cannot be used in this case. - Calculate the natural accuracy by dividing the non-fraud cases over the total observations.

- Print the percentage.

1

2

| df2 = pd.read_csv(cc2_file)

df2.head()

|

| Unnamed: 0 | V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | V10 | V11 | V12 | V13 | V14 | V15 | V16 | V17 | V18 | V19 | V20 | V21 | V22 | V23 | V24 | V25 | V26 | V27 | V28 | Amount | Class |

|---|

| 0 | 221547 | -1.191668 | 0.428409 | 1.640028 | -1.848859 | -0.870903 | -0.204849 | -0.385675 | 0.352793 | -1.098301 | -0.334597 | -0.679089 | -0.039671 | 1.372661 | -0.732001 | -0.344528 | 1.024751 | 0.380209 | -1.087349 | 0.364507 | 0.051924 | 0.507173 | 1.292565 | -0.467752 | 1.244887 | 0.697707 | 0.059375 | -0.319964 | -0.017444 | 27.44 | 0 |

|---|

| 1 | 184524 | 1.966614 | -0.450087 | -1.228586 | 0.142873 | -0.150627 | -0.543590 | -0.076217 | -0.108390 | 0.973310 | -0.029903 | 0.279973 | 0.885685 | -0.583912 | 0.322019 | -1.065335 | -0.340285 | -0.385399 | 0.216554 | 0.675646 | -0.190851 | 0.124055 | 0.564916 | -0.039331 | -0.283904 | 0.186400 | 0.192932 | -0.039155 | -0.071314 | 35.95 | 0 |

|---|

| 2 | 91201 | 1.528452 | -1.296191 | -0.890677 | -2.504028 | 0.803202 | 3.350793 | -1.633016 | 0.815350 | -1.884692 | 1.465259 | -0.188235 | -0.976779 | 0.560550 | -0.250847 | 0.936115 | 0.136409 | -0.078251 | 0.355086 | 0.127756 | -0.163982 | -0.412088 | -1.017485 | 0.129566 | 0.948048 | 0.287826 | -0.396592 | 0.042997 | 0.025853 | 28.40 | 0 |

|---|

| 3 | 26115 | -0.774614 | 1.100916 | 0.679080 | 1.034016 | 0.168633 | 0.874582 | 0.209454 | 0.770550 | -0.558106 | -0.165442 | 0.017562 | 0.285377 | -0.818739 | 0.637991 | -0.370124 | -0.605148 | 0.275686 | 0.246362 | 1.331927 | 0.080978 | 0.011158 | 0.146017 | -0.130401 | -0.848815 | 0.005698 | -0.183295 | 0.282940 | 0.123856 | 43.20 | 0 |

|---|

| 4 | 201292 | -1.075860 | 1.361160 | 1.496972 | 2.242604 | 1.314751 | 0.272787 | 1.005246 | 0.132932 | -1.558317 | 0.484216 | -1.967998 | -1.818338 | -2.036184 | 0.346962 | -1.161316 | 1.017093 | -0.926787 | 0.183965 | -2.102868 | -0.354008 | 0.254485 | 0.530692 | -0.651119 | 0.626389 | 1.040212 | 0.249501 | -0.146745 | 0.029714 | 10.59 | 0 |

|---|

1

2

| X, y = prep_data(df2)

print(f'X shape: {X.shape}\ny shape: {y.shape}')

|

1

2

| X shape: (7300, 28)

y shape: (7300,)

|

1

2

3

4

5

6

7

| array([ 4.28408570e-01, 1.64002800e+00, -1.84885886e+00, -8.70902974e-01,

-2.04848888e-01, -3.85675453e-01, 3.52792552e-01, -1.09830131e+00,

-3.34596757e-01, -6.79088729e-01, -3.96709268e-02, 1.37266082e+00,

-7.32000706e-01, -3.44528134e-01, 1.02475103e+00, 3.80208554e-01,

-1.08734881e+00, 3.64507163e-01, 5.19236276e-02, 5.07173439e-01,

1.29256539e+00, -4.67752261e-01, 1.24488683e+00, 6.97706854e-01,

5.93750372e-02, -3.19964326e-01, -1.74444289e-02, 2.74400000e+01])

|

1

| df2.Class.value_counts()

|

1

2

3

4

| Class

0 7000

1 300

Name: count, dtype: int64

|

1

2

3

| # Count the total number of observations from the length of y

total_obs = len(y)

total_obs

|

1

2

3

4

| # Count the total number of non-fraudulent observations

non_fraud = [i for i in y if i == 0]

count_non_fraud = non_fraud.count(0)

count_non_fraud

|

1

2

| percentage = count_non_fraud/total_obs * 100

print(f'{percentage:0.2f}%')

|

This tells us that by doing nothing, we would be correct in 95.9% of the cases. So now you understand, that if we get an accuracy of less than this number, our model does not actually add any value in predicting how many cases are correct. Let’s see how a random forest does in predicting fraud in our data.

Random Forest Classifier - part 1

Let’s now create a first random forest classifier for fraud detection. Hopefully you can do better than the baseline accuracy you’ve just calculated, which was roughly 96%. This model will serve as the “baseline” model that you’re going to try to improve in the upcoming exercises. Let’s start first with splitting the data into a test and training set, and defining the Random Forest model. The data available are features X and labels y.

Instructions

- Import the random forest classifier from

sklearn. - Split your features

X and labels y into a training and test set. Set aside a test set of 30%. - Assign the random forest classifier to

model and keep random_state at 5. We need to set a random state here in order to be able to compare results across different models.

X_train, X_test, y_train, y_test

1

2

| # Split your data into training and test set

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.3, random_state=0)

|

1

2

| # Define the model as the random forest

model = RandomForestClassifier(random_state=5, n_estimators=20)

|

Random Forest Classifier - part 2

Let’s see how our Random Forest model performs without doing anything special to it. The model from the previous exercise is available, and you’ve already split your data in X_train, y_train, X_test, y_test.

Instructions 1/3

- Fit the earlier defined

model to our training data and obtain predictions by getting the model predictions on X_test.

1

2

| # Fit the model to our training set

model.fit(X_train, y_train)

|

RandomForestClassifier(n_estimators=20, random_state=5)

In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook.

On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.1

2

| # Obtain predictions from the test data

predicted = model.predict(X_test)

|

Instructions 2/3

- Obtain and print the accuracy score by comparing the actual labels

y_test with our predicted labels predicted.

1

| print(f'Accuracy Score:\n{accuracy_score(y_test, predicted):0.3f}')

|

1

2

| Accuracy Score:

0.991

|

Instructions 3/3

What is a benefit of using Random Forests versus Decision Trees?

Possible Answers

Random Forests always have a higher accuracy than Decision Trees.- Random Forests do not tend to overfit, whereas Decision Trees do.

Random Forests are computationally more efficient than Decision Trees.You can obtain “feature importance” from Random Forest, which makes it more transparent.

Random Forest prevents overfitting most of the time, by creating random subsets of the features and building smaller trees using these subsets. Afterwards, it combines the subtrees of subsamples of features, so it does not tend to overfit to your entire feature set the way “deep” Decisions Trees do.

Perfomance evaluation

- Performance metrics for fraud detection models

- There are other performace metrics that are more informative and reliable than accuracy

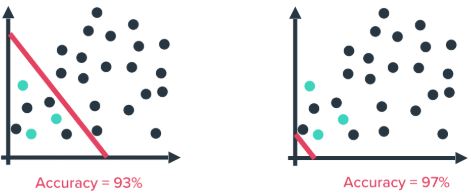

Accuracy

- Accuracy isn’t a reliable performance metric when working with highly imbalanced data (such as fraud detection)

- By doing nothing, aka predicting everything is the majority class (right image), a higher accuracy is obtained than by trying to build a predictive model (left image)

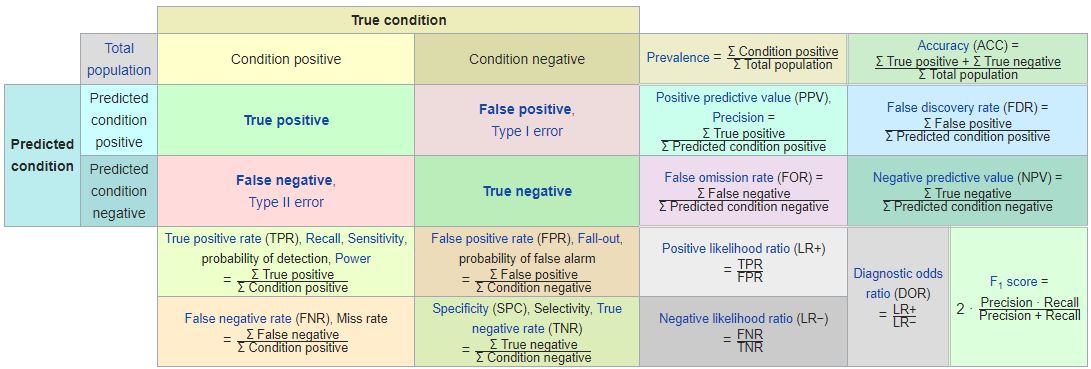

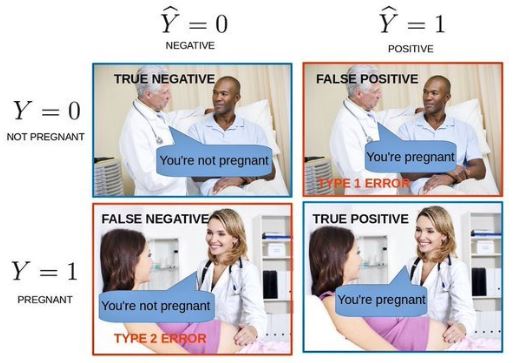

Confusion Matrix

- Confusion Matrix

- False Positives (FP) / False Negatives (FN)

- FN: predicts the person is not pregnant, but actually is

- Cases of fraud not caught by the model

- FP: predicts the person is pregnant, but actually is not

- the business case determines whether FN or FP cases are more important

- a credit card company might want to catch as much fraud as possible and reduce false negatives, as fraudulent transactions can be incredibly costly

- a false alarm just means a transaction is blocked

- an insurance company can’t handle many false alarms, as it means getting a team of investigators involved for each positive prediction

- True Positives / True Negatives are the cases predicted correctly (e.g. fraud / non-fraud)

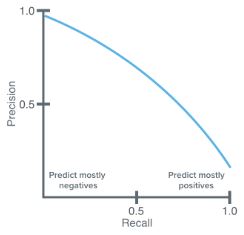

Precision Recall

- Credit card company wants to optimize for recall

- Insurance company wants to optimize for precision

- Precision:

- \[Precision=\frac{\#\space True\space Positives}{\#\space True\space Positives+\#\space False\space Positives}\]

- Fraction of actual fraud cases out of all predicted fraud cases

- true positives relative to the sum of true positives and false positives

- Recall:

- \[Recall=\frac{\#\space True\space Positives}{\#\space True\space Positives+\#\space False\space Negatives}\]

- Fraction of predicted fraud cases out of all actual fraud cases

- true positives relative to the sum of true positives and false negative

- Precision and recall are typically inversely related

- As precision increases, recall falls and vice-versa

F-Score

- Weighs both precision and recall into on measure

\begin{align} F-measure = \frac{2\times{Precision}\times{Recall}}{Precision\times{Recall}} \

= \frac{2\times{TP}}{2\times{TP}+FP+FN} \end{align}

- is a performance metric that takes into account a balance between Precision and Recall

1

2

3

4

5

6

7

8

| # import the methods

from sklearn.metrics import precision_recall_curve, average_precision_score

# Calculate average precision and the PR curve

average_precision = average_precision_score(y_test, predicted)

# Obtain precision and recall

precision, recall = precision_recall_curve(y_test, predicted)

|

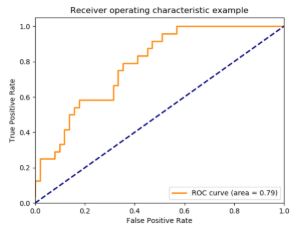

Receiver Operating Characteristic (ROC) curve to compare algorithms

- Created by plotting the true positive rate against the false positive rate at various threshold settings

- Useful for comparing performance of different algorithms

1

2

3

4

5

| # Obtain model probabilities

probs = model.predict_proba(X_test)

# Print ROC_AUC score using probabilities

print(metrics.roc_auc_score(y_test, probs[:, 1]))

|

Confusion matrix and classification report

1

2

3

4

5

6

7

8

9

10

| from sklearn.metrics import classification_report, confusion_matrix

# Obtain predictions

predicted = model.predict(X_test)

# Print classification report using predictions

print(classification_report(y_test, predicted))

# Print confusion matrix using predictions

print(confusion_matrix(y_test, predicted))

|

In the previous exercises you obtained an accuracy score for your random forest model. This time, we know accuracy can be misleading in the case of fraud detection. With highly imbalanced fraud data, the AUROC curve is a more reliable performance metric, used to compare different classifiers. Moreover, the classification report tells you about the precision and recall of your model, whilst the confusion matrix actually shows how many fraud cases you can predict correctly. So let’s get these performance metrics.

You’ll continue working on the same random forest model from the previous exercise. Your model, defined as model = RandomForestClassifier(random_state=5) has been fitted to your training data already, and X_train, y_train, X_test, y_test are available.

Instructions

- Import the classification report, confusion matrix and ROC score from

sklearn.metrics. - Get the binary predictions from your trained random forest

model. - Get the predicted probabilities by running the

predict_proba() function. - Obtain classification report and confusion matrix by comparing

y_test with predicted.

1

2

| # Obtain the predictions from our random forest model

predicted = model.predict(X_test)

|

1

2

| # Predict probabilities

probs = model.predict_proba(X_test)

|

1

2

3

4

5

6

7

| # Print the ROC curve, classification report and confusion matrix

print('ROC Score:')

print(roc_auc_score(y_test, probs[:,1]))

print('\nClassification Report:')

print(classification_report(y_test, predicted))

print('\nConfusion Matrix:')

print(confusion_matrix(y_test, predicted))

|

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

| ROC Score:

0.9419896444670147

Classification Report:

precision recall f1-score support

0 0.99 1.00 1.00 2099

1 0.97 0.80 0.88 91

accuracy 0.99 2190

macro avg 0.98 0.90 0.94 2190

weighted avg 0.99 0.99 0.99 2190

Confusion Matrix:

[[2097 2]

[ 18 73]]

|

You have now obtained more meaningful performance metrics that tell us how well the model performs, given the highly imbalanced data that you’re working with. The model predicts 76 cases of fraud, out of which 73 are actual fraud. You have only 3 false positives. This is really good, and as a result you have a very high precision score. You do however, miss 18 cases of actual fraud. Recall is therefore not as good as precision.

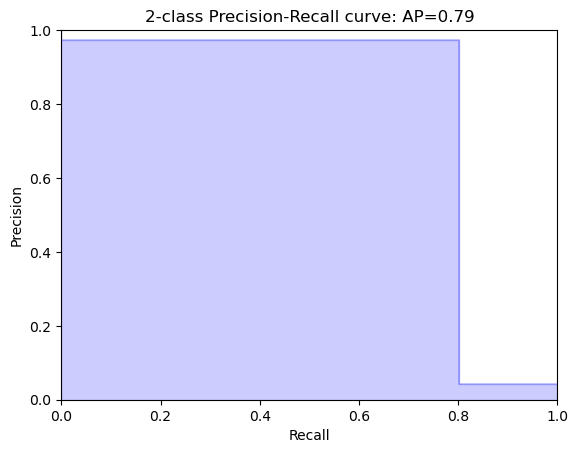

Plotting the Precision vs. Recall Curve

You can also plot a Precision-Recall curve, to investigate the trade-off between the two in your model. In this curve Precision and Recall are inversely related; as Precision increases, Recall falls and vice-versa. A balance between these two needs to be achieved in your model, otherwise you might end up with many false positives, or not enough actual fraud cases caught. To achieve this and to compare performance, the precision-recall curves come in handy.

Your Random Forest Classifier is available as model, and the predictions as predicted. You can simply obtain the average precision score and the PR curve from the sklearn package. The function plot_pr_curve() plots the results for you. Let’s give it a try.

Instructions 1/3

- Calculate the average precision by running the function on the actual labels

y_test and your predicted labels predicted.

1

2

3

| # Calculate average precision and the PR curve

average_precision = average_precision_score(y_test, predicted)

average_precision

|

Instructions 2/3

- Run the

precision_recall_curve() function on the same arguments y_test and predicted and plot the curve (this last thing has been done for you).

1

2

3

| # Obtain precision and recall

precision, recall, _ = precision_recall_curve(y_test, predicted)

print(f'Precision: {precision}\nRecall: {recall}')

|

1

2

| Precision: [0.04155251 0.97333333 1. ]

Recall: [1. 0.8021978 0. ]

|

def plot_pr_curve

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

| def plot_pr_curve(recall, precision, average_precision):

"""

https://scikit-learn.org/stable/auto_examples/model_selection/plot_precision_recall.html

"""

from inspect import signature

plt.figure()

step_kwargs = ({'step': 'post'}

if 'step' in signature(plt.fill_between).parameters

else {})

plt.step(recall, precision, color='b', alpha=0.2, where='post')

plt.fill_between(recall, precision, alpha=0.2, color='b', **step_kwargs)

plt.xlabel('Recall')

plt.ylabel('Precision')

plt.ylim([0.0, 1.0])

plt.xlim([0.0, 1.0])

plt.title(f'2-class Precision-Recall curve: AP={average_precision:0.2f}')

return plt.show()

|

1

2

| # Plot the recall precision tradeoff

plot_pr_curve(recall, precision, average_precision)

|

Instructions 3/3

What’s the benefit of the performance metric ROC curve (AUROC) versus Precision and Recall?

Possible Answers

- The AUROC answers the question: “How well can this classifier be expected to perform in general, at a variety of different baseline probabilities?” but precision and recall don’t.

The AUROC answers the question: “How meaningful is a positive result from my classifier given the baseline probabilities of my problem?” but precision and recall don’t.Precision and Recall are not informative when the data is imbalanced.The AUROC curve allows you to visualize classifier performance and with Precision and Recall you cannot.

The ROC curve plots the true positives vs. false positives , for a classifier, as its discrimination threshold is varied. Since, a random method describes a horizontal curve through the unit interval, it has an AUC of 0.5. Minimally, classifiers should perform better than this, and the extent to which they score higher than one another (meaning the area under the ROC curve is larger), they have better expected performance.

Adjusting the algorithm weights

- Adjust model parameter to optimize for fraud detection.

- When training a model, try different options and settings to get the best recall-precision trade-off

- sklearn has two simple options to tweak the model for heavily imbalanced data

class_weight:balanced mode: model = RandomForestClassifier(class_weight='balanced')- uses the values of y to automatically adjust weights inversely proportional to class frequencies in the the input data

- this option is available for other classifiers

model = LogisticRegression(class_weight='balanced')model = SVC(kernel='linear', class_weight='balanced', probability=True)

balanced_subsample mode: model = RandomForestClassifier(class_weight='balanced_subsample')- is the same as the

balanced option, except weights are calculated again at each iteration of growing a tree in a the random forest - this option is only applicable for the Random Forest model

- manual input

- adjust weights to any ratio, not just value counts relative to sample

class_weight={0:1,1:4}- this is a good option to slightly upsample the minority class

Hyperparameter tuning

- Random Forest takes many other options to optimize the model

1

2

3

4

5

6

7

| model = RandomForestClassifier(n_estimators=10,

criterion=’gini’,

max_depth=None,

min_samples_split=2,

min_samples_leaf=1,

max_features=’auto’,

n_jobs=-1, class_weight=None)

|

- the shape and size of the trees in a random forest are adjusted with leaf size and tree depth

n_estimators: one of the most important setting is the number of trees in the forestmax_features: the number of features considered for splitting at each leaf nodecriterion: change the way the data is split at each node (default is gini coefficient)

GridSearchCV for hyperparameter tuning

- sklearn.model_selection.GridSearchCV

from sklearn.model_selection import GridSearchCV- `GridSearchCV evaluates all combinations of parameters defined in the parameter grid

- Random Forest Parameter Grid:

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

| # Create the parameter grid

param_grid = {'max_depth': [80, 90, 100, 110],

'max_features': [2, 3],

'min_samples_leaf': [3, 4, 5],

'min_samples_split': [8, 10, 12],

'n_estimators': [100, 200, 300, 1000]}

# Define which model to use

model = RandomForestRegressor()

# Instantiate the grid search model

grid_search_model = GridSearchCV(estimator = model,

param_grid = param_grid,

cv = 5,

n_jobs = -1,

scoring='f1')

|

- define the ML model to be used

- put the model into

GridSearchCV - pass in

param_grid - frequency of cross-validation

- define a scoring metric to evaluate the models

- the default option is accuracy which isn’t optimal for fraud detection

- use

precision, recall or f1

1

2

3

4

5

6

7

8

9

10

11

12

| # Fit the grid search to the data

grid_search_model.fit(X_train, y_train)

# Get the optimal parameters

grid_search_model.best_params_

{'bootstrap': True,

'max_depth': 80,

'max_features': 3,

'min_samples_leaf': 5,

'min_samples_split': 12,

'n_estimators': 100}

|

- once

GridSearchCV and model are fit to the data, obtain the parameters belonging to the optimal model by using the best_params_ attribute GridSearchCV is computationally heavy- Can require many hours, depending on the amount of data and number of parameters in the grid

- **Save the Results**

1

2

3

| # Get the best_estimator results

grid_search.best_estimator_

grid_search.best_score_

|

best_score_: mean cross-validated score of the best_estimator_, which depends on the scoring option

Model adjustments

A simple way to adjust the random forest model to deal with highly imbalanced fraud data, is to use the class_weights option when defining the sklearn model. However, as you will see, it is a bit of a blunt force mechanism and might not work for your very special case.

In this exercise you’ll explore the weight = "balanced_subsample" mode the Random Forest model from the earlier exercise. You already have split your data in a training and test set, i.e X_train, X_test, y_train, y_test are available. The metrics function have already been imported.

Instructions

- Set the

class_weight argument of your classifier to balanced_subsample. - Fit your model to your training set.

- Obtain predictions and probabilities from X_test.

- Obtain the

roc_auc_score, the classification report and confusion matrix.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

| # Define the model with balanced subsample

model = RandomForestClassifier(class_weight='balanced_subsample', random_state=5, n_estimators=100)

# Fit your training model to your training set

model.fit(X_train, y_train)

# Obtain the predicted values and probabilities from the model

predicted = model.predict(X_test)

probs = model.predict_proba(X_test)

# Print the ROC curve, classification report and confusion matrix

print('ROC Score:')

print(roc_auc_score(y_test, probs[:,1]))

print('\nClassification Report:')

print(classification_report(y_test, predicted))

print('\nConfusion Matrix:')

print(confusion_matrix(y_test, predicted))

|

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

| ROC Score:

0.9750299724096771

Classification Report:

precision recall f1-score support

0 0.99 1.00 1.00 2099

1 0.99 0.80 0.88 91

accuracy 0.99 2190

macro avg 0.99 0.90 0.94 2190

weighted avg 0.99 0.99 0.99 2190

Confusion Matrix:

[[2098 1]

[ 18 73]]

|

You can see that the model results don’t improve drastically. We now have 3 less false positives, but now 19 in stead of 18 false negatives, i.e. cases of fraud we are not catching. If we mostly care about catching fraud, and not so much about the false positives, this does actually not improve our model at all, albeit a simple option to try. In the next exercises you’ll see how to more smartly tweak your model to focus on reducing false negatives and catch more fraud.

Adjusting RF for fraud detection

In this exercise you’re going to dive into the options for the random forest classifier, as we’ll assign weights and tweak the shape of the decision trees in the forest. You’ll define weights manually, to be able to off-set that imbalance slightly. In our case we have 300 fraud to 7000 non-fraud cases, so by setting the weight ratio to 1:12, we get to a 1/3 fraud to 2/3 non-fraud ratio, which is good enough for training the model on.

The data in this exercise has already been split into training and test set, so you just need to focus on defining your model. You can then use the function get_model_results() as a short cut. This function fits the model to your training data, predicts and obtains performance metrics similar to the steps you did in the previous exercises.

Instructions

- Change the

weight option to set the ratio to 1 to 12 for the non-fraud and fraud cases, and set the split criterion to ‘entropy’. - Set the maximum depth to 10.

- Set the minimal samples in leaf nodes to 10.

- Set the number of trees to use in the model to 20.

def get_model_results

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

| def get_model_results(X_train: np.ndarray, y_train: np.ndarray,

X_test: np.ndarray, y_test: np.ndarray, model):

"""

model: sklearn model (e.g. RandomForestClassifier)

"""

# Fit your training model to your training set

model.fit(X_train, y_train)

# Obtain the predicted values and probabilities from the model

predicted = model.predict(X_test)

try:

probs = model.predict_proba(X_test)

print('ROC Score:')

print(roc_auc_score(y_test, probs[:,1]))

except AttributeError:

pass

# Print the ROC curve, classification report and confusion matrix

print('\nClassification Report:')

print(classification_report(y_test, predicted))

print('\nConfusion Matrix:')

print(confusion_matrix(y_test, predicted))

|

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

| # Change the model options

model = RandomForestClassifier(bootstrap=True,

class_weight={0:1, 1:12},

criterion='entropy',

# Change depth of model

max_depth=10,

# Change the number of samples in leaf nodes

min_samples_leaf=10,

# Change the number of trees to use

n_estimators=20,

n_jobs=-1,

random_state=5)

# Run the function get_model_results

get_model_results(X_train, y_train, X_test, y_test, model)

|

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

| ROC Score:

0.9609651901219315

Classification Report:

precision recall f1-score support

0 0.99 1.00 1.00 2099

1 0.97 0.85 0.91 91

accuracy 0.99 2190

macro avg 0.98 0.92 0.95 2190

weighted avg 0.99 0.99 0.99 2190

Confusion Matrix:

[[2097 2]

[ 14 77]]

|

By smartly defining more options in the model, you can obtain better predictions. You have effectively reduced the number of false negatives, i.e. you are catching more cases of fraud, whilst keeping the number of false positives low. In this exercise you’ve manually changed the options of the model. There is a smarter way of doing it, by using GridSearchCV, which you’ll see in the next exercise!

Parameter optimization with GridSearchCV

In this exercise you’re going to tweak our model in a less “random” way, but use GridSearchCV to do the work for you.

With GridSearchCV you can define which performance metric to score the options on. Since for fraud detection we are mostly interested in catching as many fraud cases as possible, you can optimize your model settings to get the best possible Recall score. If you also cared about reducing the number of false positives, you could optimize on F1-score, this gives you that nice Precision-Recall trade-off.

GridSearchCV has already been imported from sklearn.model_selection, so let’s give it a try!

Instructions

- Define in the parameter grid that you want to try 1 and 30 trees, and that you want to try the

gini and entropy split criterion. - Define the model to be simple

RandomForestClassifier, you want to keep the random_state at 5 to be able to compare models. - Set the

scoring option such that it optimizes for recall. - Fit the model to the training data

X_train and y_train and obtain the best parameters for the model.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

| # Define the parameter sets to test

param_grid = {'n_estimators': [1, 30],

'max_features': ['auto', 'log2'],

'max_depth': [4, 8, 10, 12],

'criterion': ['gini', 'entropy']}

# Define the model to use

model = RandomForestClassifier(random_state=5)

# Combine the parameter sets with the defined model

CV_model = GridSearchCV(estimator=model, param_grid=param_grid, cv=5, scoring='recall', n_jobs=-1)

# Fit the model to our training data and obtain best parameters

CV_model.fit(X_train, y_train)

CV_model.best_params_

|

1

2

3

4

| {'criterion': 'gini',

'max_depth': 8,

'max_features': 'log2',

'n_estimators': 30}

|

Model results with GridSearchCV

You discovered that the best parameters for your model are that the split criterion should be set to 'gini', the number of estimators (trees) should be 30, the maximum depth of the model should be 8 and the maximum features should be set to "log2".

Let’s give this a try and see how well our model performs. You can use the get_model_results() function again to save time.

Instructions

- Input the optimal settings into the model definition.

- Fit the model, obtain predictions and get the performance parameters with

get_model_results().

1

2

3

4

5

6

7

8

9

10

11

12

| # Input the optimal parameters in the model

model = RandomForestClassifier(class_weight={0:1,1:12},

criterion='gini',

max_depth=8,

max_features='log2',

min_samples_leaf=10,

n_estimators=30,

n_jobs=-1,

random_state=5)

# Get results from your model

get_model_results(X_train, y_train, X_test, y_test, model)

|

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

| ROC Score:

0.9749697658225529

Classification Report:

precision recall f1-score support

0 0.99 1.00 1.00 2099

1 0.95 0.84 0.89 91

accuracy 0.99 2190

macro avg 0.97 0.92 0.94 2190

weighted avg 0.99 0.99 0.99 2190

Confusion Matrix:

[[2095 4]

[ 15 76]]

|

The model has been improved even further. The number of false positives has now been slightly reduced even further, which means we are catching more cases of fraud. However, you see that the number of false positives actually went up. That is that Precision-Recall trade-off in action. To decide which final model is best, you need to take into account how bad it is not to catch fraudsters, versus how many false positives the fraud analytics team can deal with. Ultimately, this final decision should be made by you and the fraud team together.

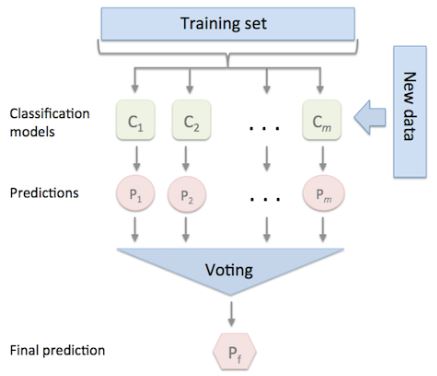

Ensemble methods

- Ensemble methods are techniques that create multiple machine learning models and then combine them to produce a final result

- Usually produce more accurate predictions than a single model

- The goal of an ML problem is to find a single model that will best predict our wanted outcome

- Use ensemble methods rather than making one model and hoping it’s best, most accurate predictor

- Ensemble methods take a myriad of models into account and average them to produce one final model

- Ensures the predictions are robust

- Less likely to be the result of overfitting

- Can improve prediction performance

- Especially by combining models with different recall and precision scores

- Are a winning formula at Kaggle competitions

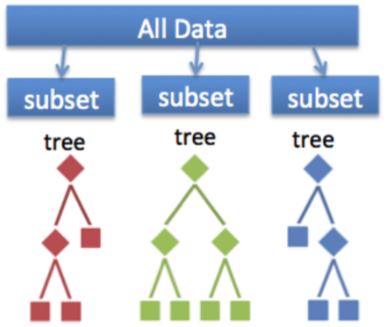

- The Random Forest classifier is an ensemble of Decision Trees

- Bootstrap Aggregation or Bagging Ensemble method

- In a Random Forest, models are trained on random subsamples of data and the results are aggregated by taking the average prediction of all the trees

Stacking Ensemble Methods

- Multiple models are combined via a “voting” rule on the model outcome

- The base level models are each trained based on the complete training set

- Unlike the Bagging method, models are not trained on a subsample of the data

- Algorithms of different types can be combined

Voting Classifier

- available in sklearn

- easy way of implementing an ensemble model

1

2

3

4

5

6

7

8

9

10

11

12

13

| from sklearn.ensemble import VotingClassifier

# Define Models

clf1 = LogisticRegression(random_state=1)

clf2 = RandomForestClassifier(random_state=1)

clf3 = GaussianNB()

# Combine models into ensemble

ensemble_model = VotingClassifier(estimators=[('lr', clf1), ('rf', clf2), ('gnb', clf3)], voting='hard')

# Fit and predict as with other models

ensemble_model.fit(X_train, y_train)

ensemble_model.predict(X_test)

|

- the

voting='hard' option uses the predicted class labels and takes the majority vote - the

voting='soft' option takes the average probability by combining the predicted probabilities of the individual models - Weights can be assigned to the

VotingClassifer with weights=[2,1,1]- Useful when one model significantly outperforms the others

Reliable Labels

- In real life it’s unlikely the data will have truly unbiased, reliable labels for the model

- In credit card fraud you often will have reliable labels, in which case, use the methods learned so far

- Most cases you’ll need to rely on unsupervised learning techniques to detect fraud

Logistic Regression

In this last lesson you’ll combine three algorithms into one model with the VotingClassifier. This allows us to benefit from the different aspects from all models, and hopefully improve overall performance and detect more fraud. The first model, the Logistic Regression, has a slightly higher recall score than our optimal Random Forest model, but gives a lot more false positives. You’ll also add a Decision Tree with balanced weights to it. The data is already split into a training and test set, i.e. X_train, y_train, X_test, y_test are available.

In order to understand how the Voting Classifier can potentially improve your original model, you should check the standalone results of the Logistic Regression model first.

Instructions

- Define a LogisticRegression model with class weights that are 1:15 for the fraud cases.

- Fit the model to the training set, and obtain the model predictions.

- Print the classification report and confusion matrix.

1

2

3

4

5

| # Define the Logistic Regression model with weights

model = LogisticRegression(class_weight={0:1, 1:15}, random_state=5, solver='liblinear')

# Get the model results

get_model_results(X_train, y_train, X_test, y_test, model)

|

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

| ROC Score:

0.9722054981702433

Classification Report:

precision recall f1-score support

0 0.99 0.98 0.99 2099

1 0.63 0.88 0.73 91

accuracy 0.97 2190

macro avg 0.81 0.93 0.86 2190

weighted avg 0.98 0.97 0.98 2190

Confusion Matrix:

[[2052 47]

[ 11 80]]

|

As you can see the Logistic Regression has quite different performance from the Random Forest. More false positives, but also a better Recall. It will therefore will a useful addition to the Random Forest in an ensemble model.

Voting Classifier

Let’s now combine three machine learning models into one, to improve our Random Forest fraud detection model from before. You’ll combine our usual Random Forest model, with the Logistic Regression from the previous exercise, with a simple Decision Tree. You can use the short cut get_model_results() to see the immediate result of the ensemble model.

Instructions

- Import the Voting Classifier package.

- Define the three models; use the Logistic Regression from before, the Random Forest from previous exercises and a Decision tree with balanced class weights.

- Define the ensemble model by inputting the three classifiers with their respective labels.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

| # Define the three classifiers to use in the ensemble

clf1 = LogisticRegression(class_weight={0:1, 1:15},

random_state=5,

solver='liblinear')

clf2 = RandomForestClassifier(class_weight={0:1, 1:12},

criterion='gini',

max_depth=8,

max_features='log2',

min_samples_leaf=10,

n_estimators=30,

n_jobs=-1,

random_state=5)

clf3 = DecisionTreeClassifier(random_state=5,

class_weight="balanced")

# Combine the classifiers in the ensemble model

ensemble_model = VotingClassifier(estimators=[('lr', clf1), ('rf', clf2), ('dt', clf3)], voting='hard')

# Get the results

get_model_results(X_train, y_train, X_test, y_test, ensemble_model)

|

1

2

3

4

5

6

7

8

9

10

11

12

13

14

| Classification Report:

precision recall f1-score support

0 0.99 1.00 0.99 2099

1 0.90 0.86 0.88 91

accuracy 0.99 2190

macro avg 0.95 0.93 0.94 2190

weighted avg 0.99 0.99 0.99 2190

Confusion Matrix:

[[2090 9]

[ 13 78]]

|

By combining the classifiers, you can take the best of multiple models. You’ve increased the cases of fraud you are catching from 76 to 78, and you only have 5 extra false positives in return. If you do care about catching as many fraud cases as you can, whilst keeping the false positives low, this is a pretty good trade-off. The Logistic Regression as a standalone was quite bad in terms of false positives, and the Random Forest was worse in terms of false negatives. By combining these together you indeed managed to improve performance.

Adjusting weights within the Voting Classifier

You’ve just seen that the Voting Classifier allows you to improve your fraud detection performance, by combining good aspects from multiple models. Now let’s try to adjust the weights we give to these models. By increasing or decreasing weights you can play with how much emphasis you give to a particular model relative to the rest. This comes in handy when a certain model has overall better performance than the rest, but you still want to combine aspects of the others to further improve your results.

For this exercise the data is already split into a training and test set, and clf1, clf2 and clf3 are available and defined as before, i.e. they are the Logistic Regression, the Random Forest model and the Decision Tree respectively.

Instructions

- Define an ensemble method where you over weigh the second classifier (

clf2) with 4 to 1 to the rest of the classifiers. - Fit the model to the training and test set, and obtain the predictions

predicted from the ensemble model. - Print the performance metrics, this is ready for you to run.

1

2

3

4

5

| # Define the ensemble model

ensemble_model = VotingClassifier(estimators=[('lr', clf1), ('rf', clf2), ('gnb', clf3)], voting='soft', weights=[1, 4, 1], flatten_transform=True)

# Get results

get_model_results(X_train, y_train, X_test, y_test, ensemble_model)

|

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

| ROC Score:

0.9739226947421326

Classification Report:

precision recall f1-score support

0 0.99 1.00 1.00 2099

1 0.94 0.85 0.89 91

accuracy 0.99 2190

macro avg 0.97 0.92 0.94 2190

weighted avg 0.99 0.99 0.99 2190

Confusion Matrix:

[[2094 5]

[ 14 77]]

|

The weight option allows you to play with the individual models to get the best final mix for your fraud detection model. Now that you have finalized fraud detection with supervised learning, let’s have a look at how fraud detetion can be done when you don’t have any labels to train on.

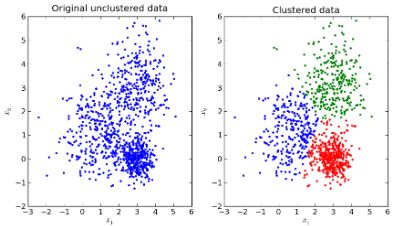

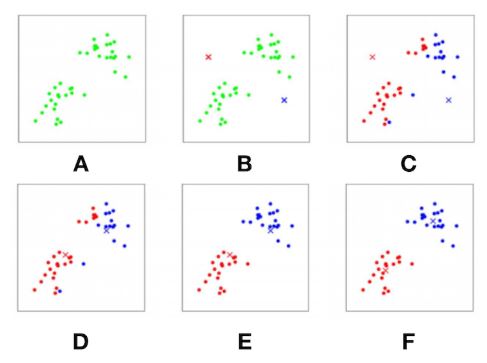

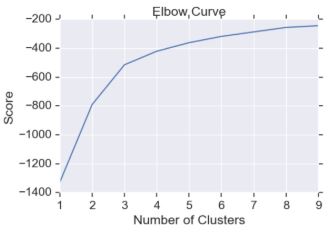

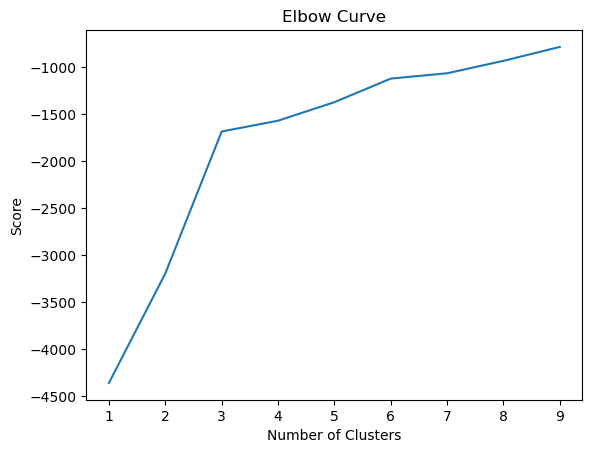

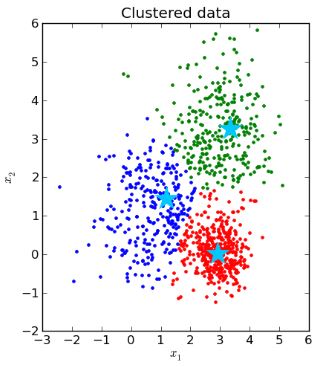

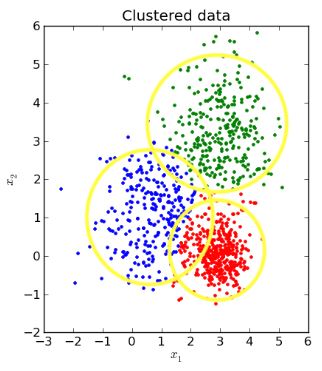

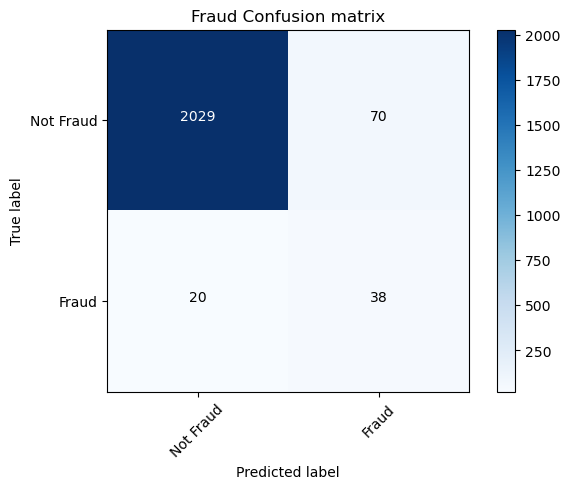

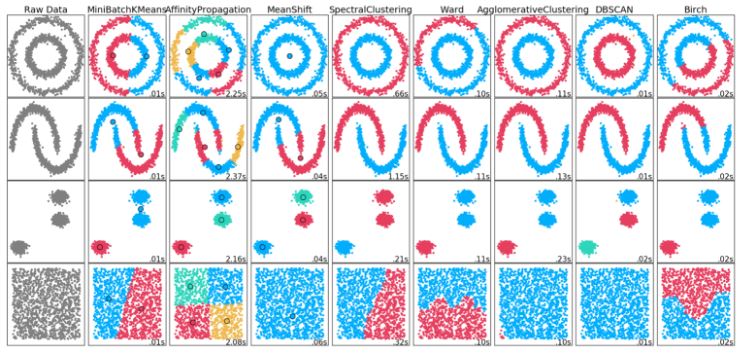

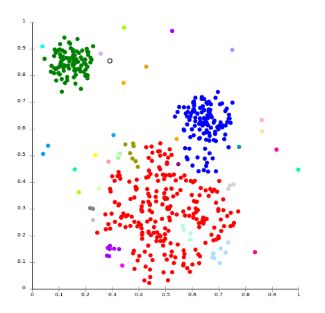

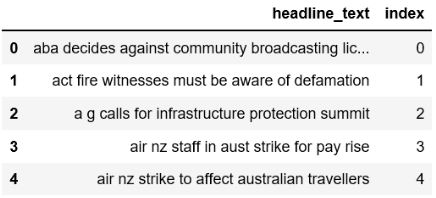

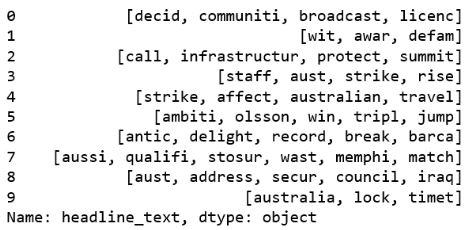

Fraud detection using unlabeled data